D

deleted126335

i would just not look at the ticker tape today. it is an illusion created by the hedge funds and doesn't reflect the reality of the situation.

i would just not look at the ticker tape today. it is an illusion created by the hedge funds and doesn't reflect the reality of the situation.

Ok. I don’t know how to lock it.yes, i agree you should lock your shares in.

i've been doing ~$800-2000 for my limit.

i figure go big.

Some brokers won’t let you set a limit that is too far from the current quote.By the way, I just read a trick on REDDIT about how to prevent your shares from being shorted (because technically, if someone borrows your shares to short, you should get paid interest...but a lot of brokers charge the interest for you, and spend the money for you...so cool of them).

Anyway, on your shares, enter a sell limit ridiculously high...that locks those shares in so they can't be loaned.

make a sell order with a limitOk. I don’t know how to lock it.

So what happens if the shorted stock goes to moon, the hedge fund bankrupt, and the brokerage has to hold the bag?

Brokerage bankrupt too?

Probably.So what happens if the shorted stock goes to moon, the hedge fund bankrupt, and the brokerage has to hold the bag?

Brokerage bankrupt too?

Citadel has over $35 billion dollars

Will try.make a sell order with a limit

Citadel did not sell the naked short directly (or at least not significantly). It is just trying to save Melvin capital. Say gme goes to 2k, the Melvin loss is 20b. Citadel says Fxck it and leaves. Melvin bankrupt. Now It is the brokerage’s responsibility to cover the shorts.

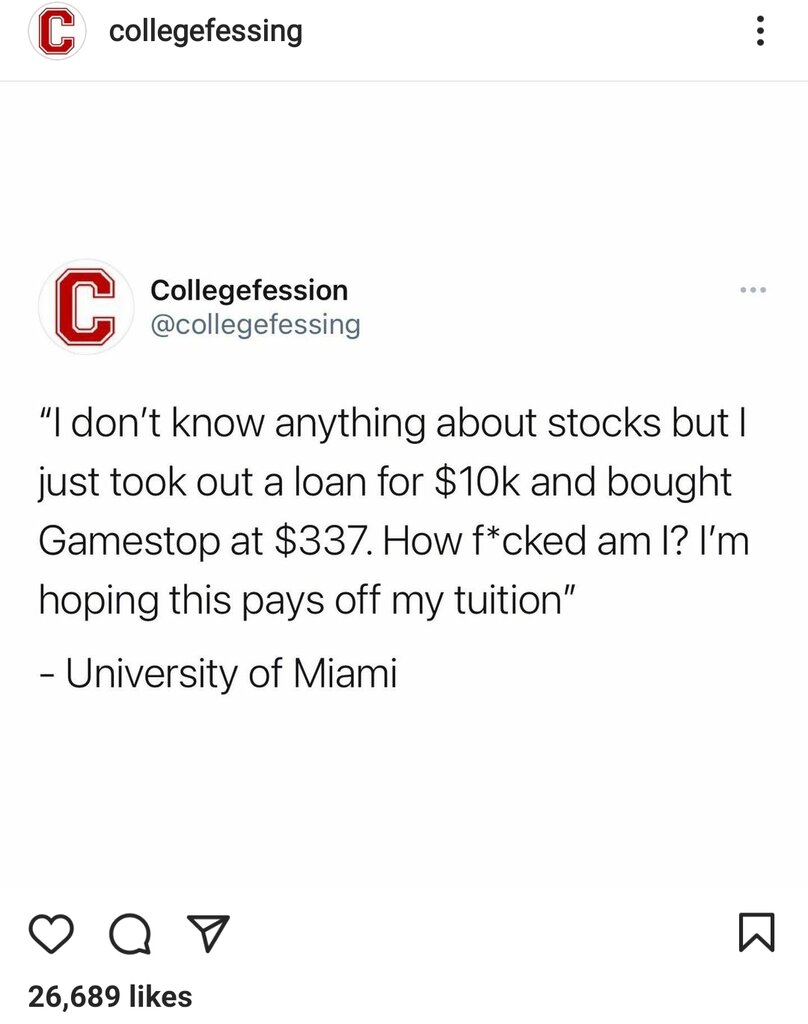

Oh ****....at least they are hopefully young.

Yup. That’s my problem. Can they just borrow my shares without my knowledge and authority though?Some brokers won’t let you set a limit that is too far from the current quote.View attachment 328509

you probably gave the consent at account opening when you clicked YES at the end of the pages long "agreement"Yup. That’s my problem. Can they just borrow my shares without my knowledge and authority though?

I think they can but don’t know that for sure.Yup. That’s my problem. Can they just borrow my shares without my knowledge and authority though?

Disclosure I have a small stake in $GME and building up decent fu fund.

My thoughts as a novice investor, so don't take this as investment advice ==

My predictions for this upcoming week. these investment bank hedge fund leaches are going to try to shock the market. GME is still massively shorted and the shorters will be massively hosed as they try to get out of their positions. It's amazing to see all the tricks they've tried to pull this week.. Monday playing massive volatility to get people to FOMO on the rapid rise and scared by the huge dip after, all the news outlet **** talk and commentary, trying to get SEC to investigate, trying to demonize wallstreetbets, getting multiple brokers to restrict trading of these stocks, lying about hedge funds meeting all their short position obligations, shutting down WSB server after hours to force panic and selling). They have tried to label this short squeeze ad a "pyramid scheme" but that's wildly inaccurate. A short squeeze is a buyout of your stock by the hedge funds no matter what price. (And that's why everyone is saying to HOLD and not sell until it gets higher). They are legally obligated, and the MM will force them to liquidate their other assets to pay for this. That is the end game and that is why they should be ****ting their pants.

So they are putting on a brave face. Fear is the only weapon they have left. But too many of the small investors don't give a damn and won't back down. It isn't just about thr money. This has become a movement. People want to see the hedge funds burn.. I suspect the broad market sell-off right now is relating to both 1. Manipulation of markets to try to force SEC action to investigate, andr 2. Selling off their assets to get out of their short positions. (In my mind this is a hedge fund fire sale so great opportunity to buy up some quality stocks that you will hold long). Expect more shenanigans to come as things become increasingly desperate.

They created the game and they have manipulated it for years to screw over everyone else. Naked shorts put the owner at the risk of theoretically infinite losses. Now we are going after the weakness in their strategy, something a basic finance major would know about naked shorting, and they are crying foul.

These wall street pros are getting pwned in their own game by the n00bs.

It ain't over till the fat lady sings.Just remember I posted this early morning before all the **** that happened today went down with $GME.

I think I was pretty correct with my predictions...

lets revisit this subject in 1 weekIt ain't over till the fat lady sings.

What do you think will happen to all the *****s who bought GME at high prices, some even on margin? The hedge funds will make their money back (that's what they are good at), sooner or later, the suckers won't have much working capital left to play with.

I don't trade or speculate, but if I did I would bet that GME stock price will likely be single digits one year from now.lets revisit this subject in 1 week

This is likely true. Can shorts hold on that long? The retail investors can.I don't trade or speculate, but if I did I would bet that GME stock price will likely be single digits one year from now.

It ain't over till the fat lady sings.

What do you think will happen to all the *****s who bought GME at high prices, some even on margin? The hedge funds will make their money back (that's what they are good at), sooner or later, the suckers won't have much working capital left to play with.

Rule #1: don't lose money.

The only way GME stays at high valuations is if people keep buying. Good luck with that, given that everybody knows it's a Ponzi scheme (the company has been trading for $20 for a reason - it has an unclear future, and a negative EPS).

Apple (AAPL) is Falling and GameStop (GME) is Flying; Why I'm Buying AAPL, not GME

While it may not be sexy to buy AAPL and avoid GME, that is exactly what I’ll be doing over the next couple of days.www.nasdaq.com

"Spectacular short squeezes are nothing new, but they always end the same way. For reference, look up what happened with Dryships (DRYS) in late 2016. That stock jumped from $4 to well over $100 in just a few days, then lost over 80%, also in just a few days."

Why are you so sure about the retail investors?This is likely true. Can shorts hold on that long? The retail investors can.

The Shorts HAVE to cover - and with all the CALLS expiring each week - my guess is, they have to cover (some of them at least) very soon. And there are very few shares available.

Option premiums were ridiculous. TDAmeritrade wouldn't let me sell any (jerks....), but I called and they allowed me some covered calls. I purchased NOK, and sold covered calls at 20% of underlying. That is nuts. AMC was selling premiums (one week out) for 50% underlying. That means you could buy some shares, sell some covered calls, and the share could drop 50%, and you still would be even - AND still own the stock that will likely go up.

NOK I think is a great long play.

did u see things crash majorly today when the price went to $165? i'm sure it triggered a lot of stop loss orders which the hedge funds scooped up. but notice that it recovered very quickly even with all the market manipulations. i imagine the ups and downs of the market lately probably knocked out a lot of speculators. these shares were either bought by the hedge funds or by diamond handsWhy are you so sure about the retail investors?

First of all, some of them used margin, which may get called by the brokerages. Then, once some people do start selling, it will create an avalanche. These people are not buy-and-holders, they are speculators. They will be happy to take some profit, as long as they still can.

It closed at 193, but it's 263 after hours.did u see things crash majorly today when the price went to $165? i'm sure it triggered a lot of stop loss orders which the hedge funds scooped up. but notice that it recovered very quickly even with all the market manipulations. i imagine the ups and downs of the market lately probably knocked out a lot of speculators. these shares were either bought by the hedge funds or by diamond hands

Screw Robin hood. I am over it. Fidelity it is. They didn't let me down.you probably gave the consent at account opening when you clicked YES at the end of the pages long "agreement"

I am sorry. I am tipsy. It's my off week. Please repeat that? Because I am a woman of principle. And feel like I should have bought more. Heck maybe I will. But what?What people need to realize is that at a certain point, if enough people truly hold their actual cash-bound SHARES (not on margin, etc.) the stock price based on the shorts does not have a theoretical ceiling. It can reach 10k if nobody sells them until the shorts can actually finally start closing out.

Deleted all my limit orders as brokerages sell this information, and I will ride this out to see if the prisoner's paradox plays out favorably.

I just saw this today and didn't know about this forum till two days ago. Even though I am a reddit user. Damn I missed out on some. How much were the shares on Monday?View attachment 328528

This user was the reason why I YOLO'd on Monday. I saw his post that took him over $11 million. The fact that this guy is still holding after today's events is absolutely unbelievable.

Here's their post history: https://www.reddit.com/user/Deep****ingValue/I just saw this today and didn't know about this forum till two days ago. Even though I am a reddit user. Damn I missed out on some. How much were the shares on Monday?

View attachment 328528

This user was the reason why I YOLO'd on Monday. I saw his post that took him over $11 million. The fact that this guy is still holding after today's events is absolutely unbelievable.

That means that it was probably premeditated (pump and dump), and the SEC will put some people in prison, when all is said and done.Here's their post history: https://www.reddit.com/user/Deep****ingValue/

You can see everything their updates as time has it all began. They've held shares of GME since 2019. I'll try to find the post, but this user quoted that this was going to happen to GME in January this year

That means that it was probably premeditated (pump and dump), and the SEC will put some people in prison, when all is said and done.

They are also encouraging all the suckers to keep feeding the Ponzi, by posting screen captures like that.

Wow, you used to be so much smarter before you changed your username.you seem to have a lot vested in all this discussion. i wonder if u are holding a short position too.

ha! that's great. i ask a simple question. i've been the target of your attacks before. lets get a mod in here to deal with these ad hominem. maybe a ban is necessary.Wow, you used to be so much smarter before you changed your username.

Wow again, eikenhein! How I have misjudged you.

Feel free to report me. I maintain my opinion that your posts used to be much better.

I just saw this today and didn't know about this forum till two days ago. Even though I am a reddit user. Damn I missed out on some. How much were the shares on Monday?

Sorry, you pushed a button, and I was taken by surprise. I do have a very good opinion of you. Somehow, I expected you to have a better opinion of me, too, and to give me more credit. My mistake.awesome. i'm sure some of my older posts were quite enlightening for you.

but just because you disagree with my point of view doesn't allow you to say i have become less smart.

i asked u a question. u responded with derision and personal attacks. very mature u must be.

typically an apology would be in order, but i am a good judge of character for who u are as a person so i won't expect one.

Not exactly sure a thread from December 2019 is going to hold up when nearly every poster was crapping on GME except one dude/dudette. Their posts are bit towards the bottom of the thread.

Seems to me this person saw an opportunity when nobody else did and held extremely long term. They bought into GME when it was at it's all time low. I was hoping the same thing would happen with the airlines and cruise companies would open back up, so I threw what money I had at them. I waited 9 months and saw a little bit of gains. I guess what I'm interested in is why GME started picking up steam in September last year. Maybe instead of making a "how to pay off stupid debts" thread in October, I should have invested instead

That's what I'm trying to figure out! I mean you can buy consoles, games, handhelds, books, and every thing videogame related at any store that sells electronics now. When I was a kid, EB Games was my favorite store of all time. Eventually EB Games merged with GameStop. This was back in the mid 2000s and when I look at the chart from back then, it makes sense why the stock was priced where it was at: When I wanted to buy a videogame, I had to go to EB Games/GameStop because they controlled the market had the widest selection of games and consoles when they were released to the public.What was the fundamental thesis back then? I doubt they sell enough consoles to have a decent margin, and games/demos are just downloaded directly to the console...

View attachment 328540

View attachment 328541

View attachment 328542

What people need to realize is that at a certain point, if enough people truly hold their actual cash-bound SHARES (not on margin, etc.) the stock price based on the shorts does not have a theoretical ceiling. It can reach 10k if nobody sells them until the shorts can actually finally start closing out.

Deleted all my limit orders as brokerages sell this information, and I will ride this out to see if the prisoner's paradox plays out favorably.

Come on Man! Buy on e share. Be part of something BIG!Nothing like FOMO. All these people are just gambling at the casino. Easy come, easy go.