- Joined

- Dec 13, 2016

- Messages

- 284

- Reaction score

- 611

Summary

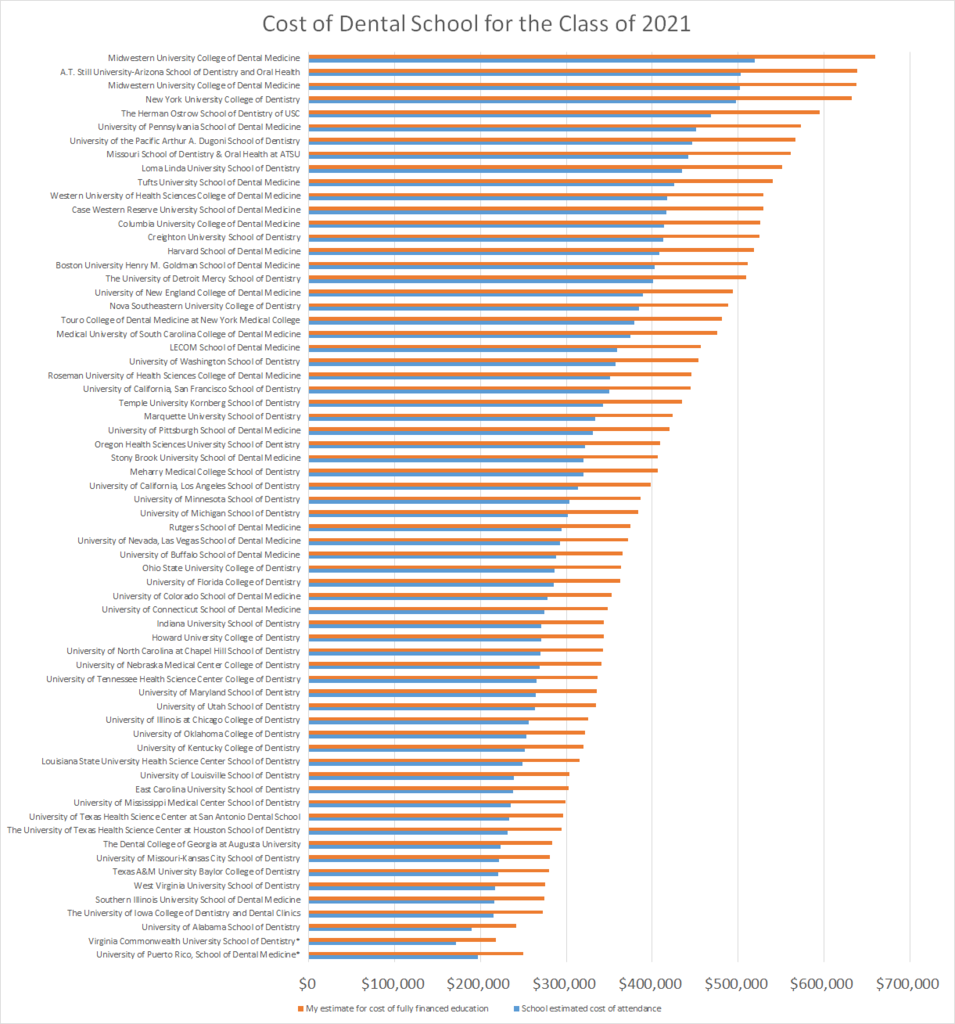

-About 10% of grads in 2021 could owe over $600,000 at graduation

-About 1 in 3 could owe over $500,000

-About 50% could owe over $400,000

-About 80% could owe over $300,000

These numbers assume that everyone attending a public state school is an in state student and qualifies for the lower tuition, so this estimate is probably low for someone financing their entire education with student loans. Current average dental school debt according to the ASDA is $261,000. That number includes people who had spouses pay for cost of living, families that paid for part of their school, HPSP scholarships that covered 3 out of 4 years etc. So my point is that if you're paying for dental school yourself, there's an 80% chance or better that you'll leave with over $300,000 in student loans for the class of 2021.

The Details

The blue bars are the current listed cost of attendance. The orange bars are my own estimate. All the numbers below represent the in state tuition cost. If you were an out of state student, from what I've researched you would probably owe over $500,000. These estimates are if you have no spousal, family, or personal financial support during school. They assume you have no scholarships, no military assistance, or anything but the federal loan program.

I'm attaching the resulting excel file below showing the links where I got the info at each school. It includes my notes on the data gathering so folks can check for themselves. I would appreciate any comments or thoughts to make it better. Also, if I'm made a mistake please let me know in the comments below.

I'm working on cost estimates for all professional programs, but wanted to post the dental results here. I've written in the past why dental schools misstate the true cost of attendance. That makes their published cost estimates not represent the true amount of student loans you could have at graduation.

Why is this? It's because they include a fraction of loan origination fees if at all. They never include future cost increases in tuition, but state in the fine print that they've "historically been between 4% to 7% per year."

Also, schools never include accrued interest in their cost of attendance. For that reason, I've found it important to multiply the 4 year school estimate for cost of attendance by 1.27 to get the true cost if you're paying for everything with student loans. I estimated $20,000 per year for living expenses if the school neglected to include an estimate.

-About 10% of grads in 2021 could owe over $600,000 at graduation

-About 1 in 3 could owe over $500,000

-About 50% could owe over $400,000

-About 80% could owe over $300,000

These numbers assume that everyone attending a public state school is an in state student and qualifies for the lower tuition, so this estimate is probably low for someone financing their entire education with student loans. Current average dental school debt according to the ASDA is $261,000. That number includes people who had spouses pay for cost of living, families that paid for part of their school, HPSP scholarships that covered 3 out of 4 years etc. So my point is that if you're paying for dental school yourself, there's an 80% chance or better that you'll leave with over $300,000 in student loans for the class of 2021.

The Details

The blue bars are the current listed cost of attendance. The orange bars are my own estimate. All the numbers below represent the in state tuition cost. If you were an out of state student, from what I've researched you would probably owe over $500,000. These estimates are if you have no spousal, family, or personal financial support during school. They assume you have no scholarships, no military assistance, or anything but the federal loan program.

I'm attaching the resulting excel file below showing the links where I got the info at each school. It includes my notes on the data gathering so folks can check for themselves. I would appreciate any comments or thoughts to make it better. Also, if I'm made a mistake please let me know in the comments below.

I'm working on cost estimates for all professional programs, but wanted to post the dental results here. I've written in the past why dental schools misstate the true cost of attendance. That makes their published cost estimates not represent the true amount of student loans you could have at graduation.

Why is this? It's because they include a fraction of loan origination fees if at all. They never include future cost increases in tuition, but state in the fine print that they've "historically been between 4% to 7% per year."

Also, schools never include accrued interest in their cost of attendance. For that reason, I've found it important to multiply the 4 year school estimate for cost of attendance by 1.27 to get the true cost if you're paying for everything with student loans. I estimated $20,000 per year for living expenses if the school neglected to include an estimate.