That was my fun fact. Gotta have fun with it.

View attachment 353704

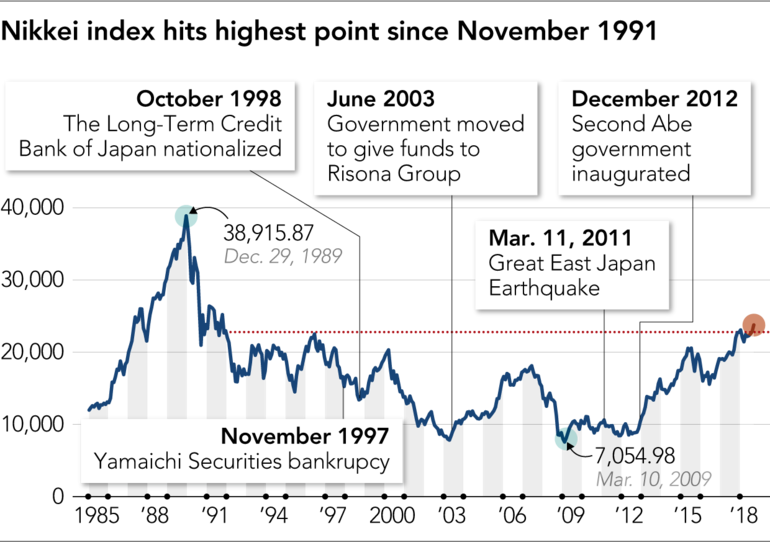

Here is my other fun fact. If you invested in Nikkei index in 1989, you are still not even.

The reality is VTI, VOO, or whatever blended index fund works really well for a majority of people. The general trend is up. 2020 and 2021 were just crazy years so we may have some correction/low years to compensate.

Also, read Buffet story if you want to see the power of compounding interest. It is pretty informative. You basically want the market stagnant in your growth phase and then rocket closer to retirement.